Call (844) 257-9947

If you are struggling with debt, you came to the right place

Our Debt Relief Programs

Debt isn’t bad, but too much of anything certainly can be! Life happens and sometimes expenses outweigh income, putting people with good intentions in difficult places.

We understand the difficulty and stress involved with managing overwhelming debt. We understand that different financial situations require different debt solutions. As a full service debt relief agency, we are here to provide resources and solutions to those looking for affordable monthly payments and a good client service experience. Sign up below for a free debt analysis!

Where Do I Start?

Take advantage of our offer for a free debt review! This initial phone call takes anywhere from 5 – 30 minutes depending on the amount of debt that you’ve accumulated. During this review we will perform a strategic analysis of your current financial situation and provide you with information about the most affordable repayment options available to you.

A debt review has zero impact on your credit score and will provide you with the estimated monthly and total program savings you could realize in one of our debt relief programs!

You can request an appointment, at your convenience, by signing up for a free debt review.

Or give us a call right now to begin your free debt review! (844) 257-9947

CAPC Client Reviews

Debt can really spiral out of control, before you know it! Dealing with it was embarrassing and humiliating for me, but CAPC customer service represen-tatives have ALWAYS treated me with dignity, kindness and respect from the beginning of the process to the end. Everything was always handled in a professional and timely manner. Thanks for the amazing and encouraging customer service!

– Loretta B.

September 2021

I am very happy with your company. They always text me about my account updates and I am impressed with how hard they are working for me to settle my accounts with my creditors. They really do what they promise! Thanks!

– Susan N.

September 2021

I can’t say enough about this company and how it has helped me get out of debt! Excellent staff who really helped me understand the process and how the program works. I am still enrolled after 2 years and have paid most of my debt!

– Mike

August 2021

Honestly the easiest company I have worked with. Their interest rates are lower and fees are a fraction of what I’d be paying on my own. They are su-per flexible and knowledgeable. Highly recommended!

– Krystal

July 2021

Warning Signs

OF TOO MUCH DEBT

- only making the minimum payments on your credit cards

- have at least one credit card maxed out

- occasionally late on making payments for credit cards and other bills

- used cash advances to pay other bills

- over drafted from your bank account

- multiple balance transfer

- dishonest with family and friends about your debt

- do not have any savings

- not aware of the actual amount of debt you owe

- denied a line of credit

Take control of your debt

GET YOUR FINANCES BACK ON TRACK

Tell Us

ABOUT YOUR DEBT

Speak with one of our credit counselors will review your finances, income and debt. They will build a realistic budget and give financial advice on how to save money.

Discover

OPTIONS & SAVINGS

Based on your current situation, we will recommend a debt relief plan that is right for you and your family. Learn how much you can save and how long to become debt free.

Enroll

IN OUR PROGRAM

We notify your creditors of your enrollment and lock your accounts into lower interest rates. Our counselors will walk you through all the simple steps to enroll in your program.

Activate

YOUR ACCOUNT

Submit one payment for your multiple creditors and service providers. We send monthly statements and bi-annual progress reports to keep you updated on your debt progress.

Are You Struggling with Debt?

YOU ARE NOT ALONE!

The average household in the US has over $16,000 in debt not including a mortgage, and pay more than $1000 in interest fees every year*. Whether it is mounting credit card debt, medical expenses, or unemployment, having debt can be very stressful. At CAPC our debt experts will help create a realistic budget, provide financial education, and offer a realistic solution to your financial problems.

Since 2004, our credit counselors have helped hundreds of thousands of individuals and families with our consulting services.

* Based on 2017 study conducted by Harris Poll on behalf of NerdWallet.

Reasons

PEOPLE SEEK CREDIT COUNSELING

- 63% claimed reduced income, change in employment or loss of their job.

- 30% struggling with medical expenses and high-interest rates

Before

SEEKING CREDIT COUNSELING

-

1/3 of the participants follow to keep a budget

-

60% follow that budget

-

56% surveyed used more than one credit card

-

21% use 5 or more

-

41% make minimum payments 30% make less than minimum payments

After

SEEKING CREDIT COUNSELING

-

73% now pay their debt more consistently

-

67% are now better at managing their money

-

70% have improved their overall financial confidence

-

$17,000 average decrease in total deb

*based on 2016 comprehensive independent evaluation of credit counseling by the NFCC

Sign Up For a Free Debt Analysis

What Our Counselors Do

Evaluate

YOUR FINANCIAL SITUATION

Budget

TO ACHIEVE FINANCIAL FREEDOM

Education

ABOUT YOUR OPTIONS

Recommend

DEBT RELIEF PROGRAM

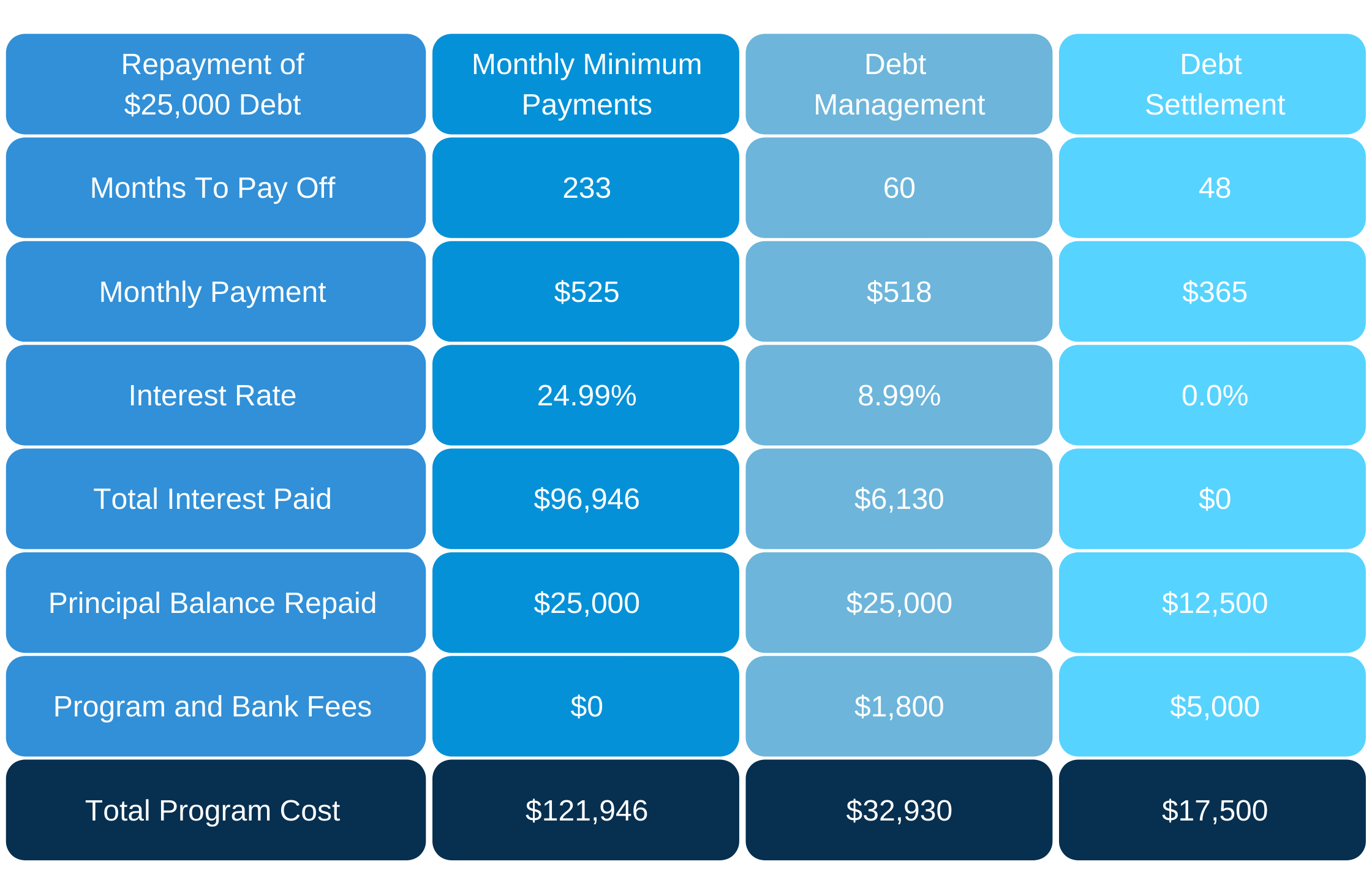

Free Savings Estimate based on debt program